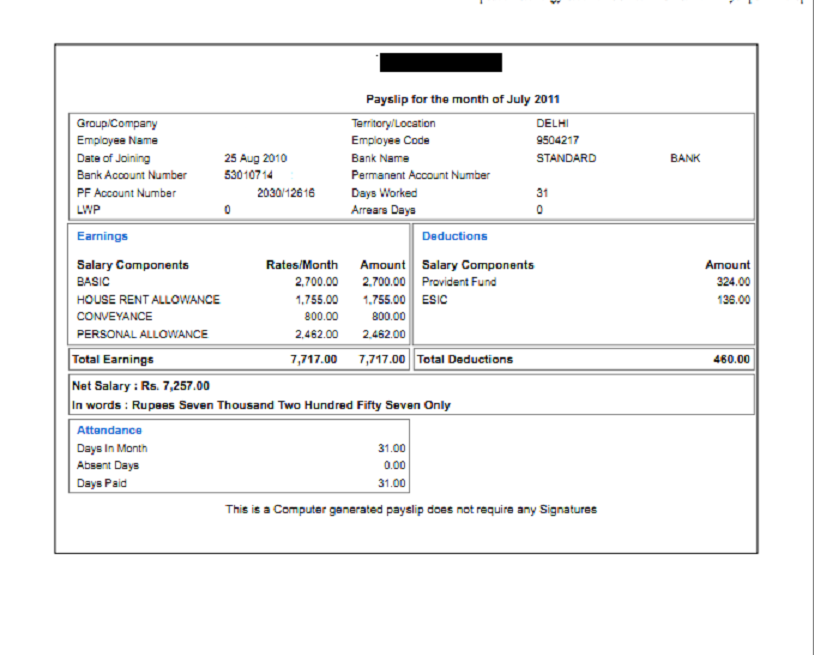

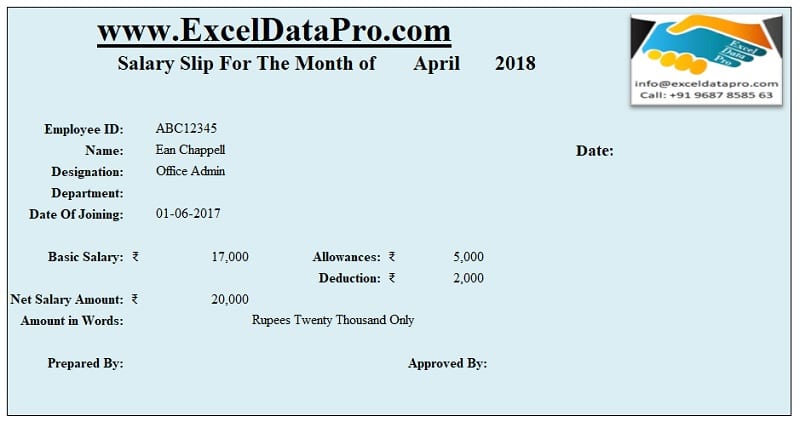

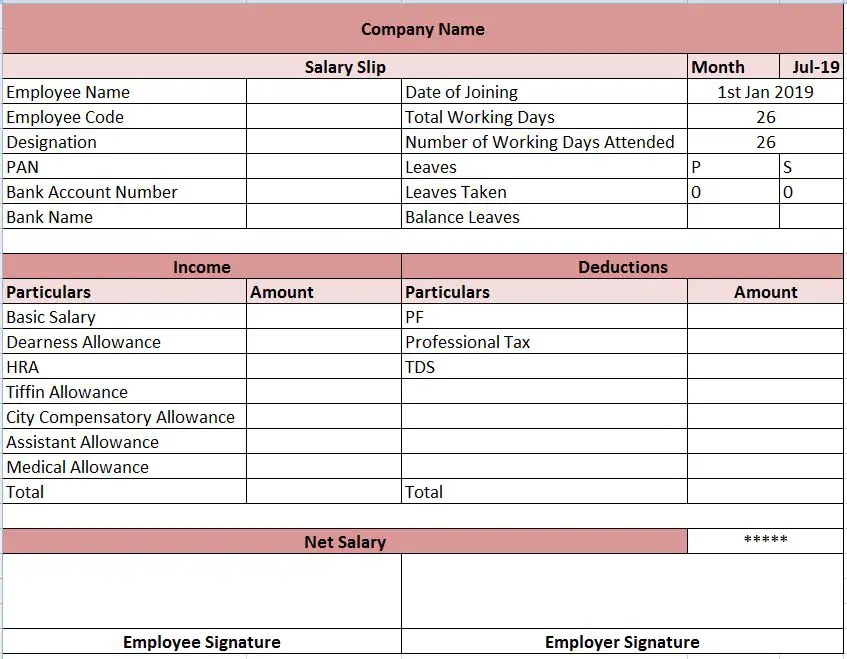

Employees can claim the following tax exemptions: Employees are not always fully exempt from paying taxes on the HRA they receive. The HRA is calculated based on the location of the rented house and is usually about 40% to 50% of the basic salary. HRAs are reimbursements to employees for house rent paid. Employees of private companies do not receive this component. Government employees and employees of public sector companies are the only ones eligible for DA. The earnings section appears after the basic pay on the pay slip. For tax purposes, DA is considered to pay, so it is taxable. The cost of living affects the amount of salary, which differs from location to location. Employees usually receive 30-40% of their basic pay as this allowance. This allowance is aimed to minimise the impact of inflation on employees. A basic salary comprises the first component of a pay slip. Based on it, a variety of other pay slip components are determined. Usually accounting for 35% to 40% of total salary, it is the most important component of compensation. But if, for some reason, an employee resigns from the company, they are not eligible to receive the salary slip that month.Ĭomponents of a salary slip can be explained in two parts: Incomes Basic Salary An employee gets their salary slip after working at a company for a month. It is not given to part-time, or contractual workers. A list of earnings (income) and deductionsĪ company shares the salary slip with full-time employees.UAN (Universal Account Number) and EPF account number.

Performance Bonus and Special Allowance.

0 kommentar(er)

0 kommentar(er)